SUBSIDIES FOR WINDOW AND DOOR JOINERY

In this section we would like to introduce you to the current opportunities to obtain financing for newly purchased pvc and aluminum window and door frames. Current recommended programs:

ec43

ec44

If you have any questions regarding these programs, please contact our sales department. - CONTACT

Exchange pvc windows and aluminum windows is undoubtedly one of the important elements of thermal modernization measures, which can effectively reduce energy losses in buildings and at the same time increase living comfort. Unfortunately, it is also often a considerable expense. Fortunately, it is possible to obtain subsidies for the replacement of pvc windows i aluminum. See how to get funding through the Clean Air Program. Plus, pvc window manufacturers i aluminum can be important partners in the process of thermal modernization. Subsidies for pvc windows and aluminum windows, as well as thermal modernization you will find within the framework of the "Clean Air" program. They provide opportunities to increase the energy efficiency of buildings and the comfort of your home. So it is worth considering replacing old windows with pvc windows or aluminum windows High-quality, which are energy-efficient.

Clean air program - target

The Clean Air Program aims to improve air quality and reduce greenhouse gas emissions by replacing heat sources, thermal insulation and improving the energy efficiency of residential buildings. The program's budget is PLN 103 billion. Applications for funding will be submitted until 31.12.2027, and disbursement of funds is assumed until 30.09.2029. The program covers modernization measures for single-family residential buildings, such as detached single-family houses or those in semi-detached, terraced or group housing. Under the program, it is also possible to replace pvc windows i aluminum, which can help improve the energy efficiency of buildings. Manufacturer of pvc windows can be an important partner in the process of thermal modernization, offering high-quality energy-saving products. Therefore, it is worth considering such an investment and taking advantage of available subsidies under the Clean Air Program.

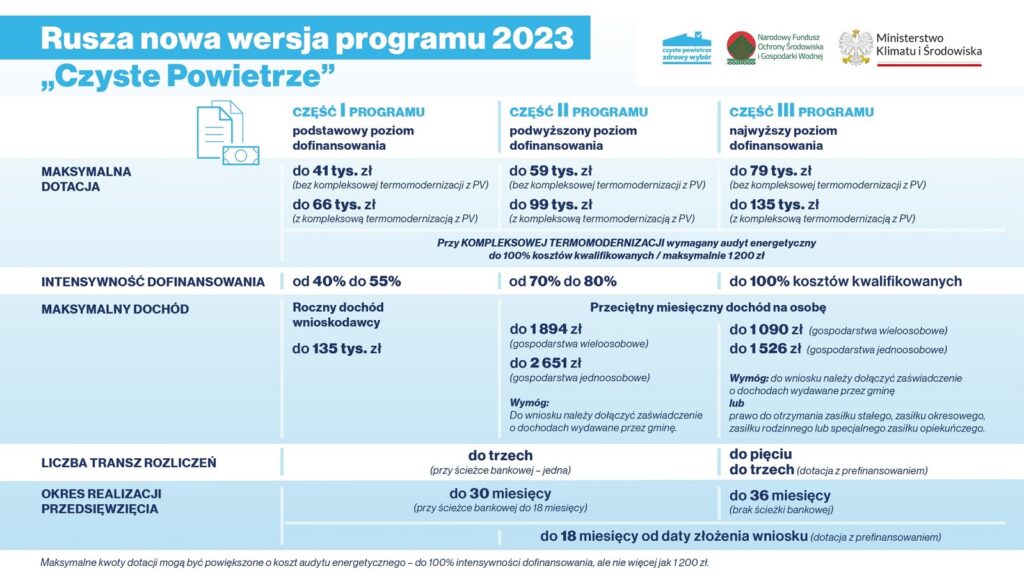

Clean Air 3.0 program, a new iteration from January 2023.

The new version of the Clean Air 3.0 program focuses mainly on increasing the energy efficiency of buildings, which includes replacing windows i door and insulation of buildings. In the case of comprehensive thermo-modernization, preceded by an energy audit, it is possible to apply for higher levels of subsidies. An important element of the Clean Air 3.0 Program is also the increase in subsidy amounts and the introduction of new income thresholds. Under the program, there is an option to replace pvc windows i aluminum windows, which can help improve the energy efficiency of buildings. It is worth using the services of manufacturers pvc windows and aluminum, who offer high-quality products that comply with the requirements of the Clean Air Program.

Who can apply for funding under the Clean Air Project?

To be eligible for Clean Air funding, two basic conditions must be met:

- The program is aimed at individuals who are owners or co-owners of a single-family residential building or a detached dwelling unit in a single-family building with a separate land register.

- Owners of several single-family homes can apply for a subsidy for each of them.

- There is no condition of residence or registration in the house.

- Subsidized homes under construction are not covered by the program.

Income thresholds that qualify for subsidies

- Basic level of funding: income threshold of PLN 135 thousand/year.

- Increased level of subsidy: income threshold in a multi-person household PLN 1,894, in a single-person household PLN 2,651.

- Highest level of subsidy: income threshold in a multi-person household PLN 1,090 per person, in a single-person household PLN 1,526.

What is the maximum subsidy under the Clean Air Program?

The maximum levels of possible funding depend on the income thresholds for which the applicant qualifies, and are respectively:

- PLN 66 thousand for the basic level of funding.

- 99 thousand zloty for the increased level of funding.

- PLN 135 thousand for the highest level of funding.

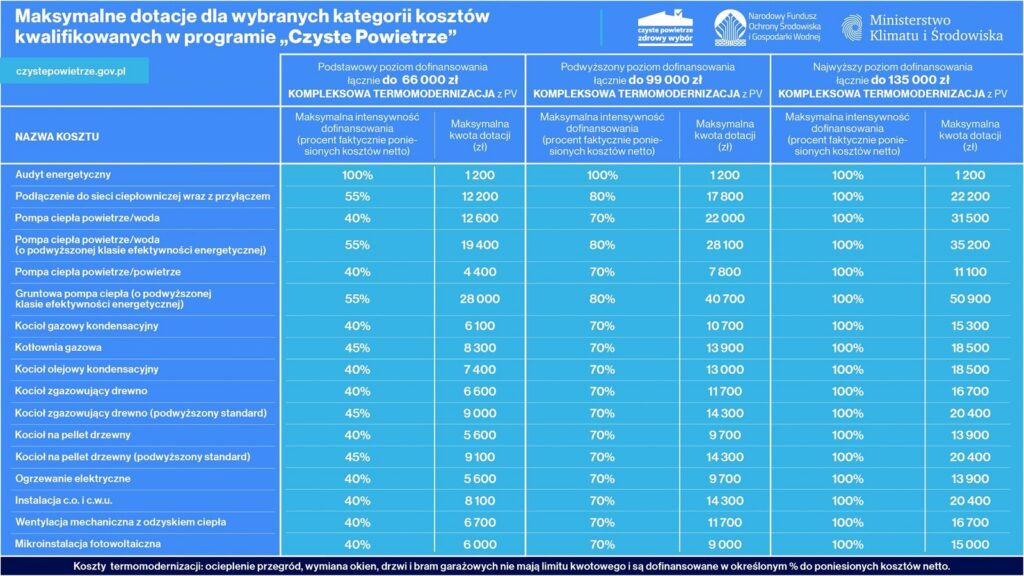

What can you get funding for and in what amount?

Under the Clean Air Program, there are specified maximum subsidy amounts and subsidy intensities for individual devices and services. However, the sum of subsidies for individual elements cannot exceed the established maximum levels. The table below shows the maximum subsidies for selected cost categories. Please note that the amounts shown are net amounts.

Comprehensive thermo-modernization with energy audit

In order to obtain a grant for comprehensive thermal modernization, it is necessary to conduct an energy audit. For performing an energy audit, you can receive a subsidy of PLN 1,200, but this amount will not be included in the overall subsidy level.

Is it possible to get funding only for thermal modernization (window replacement, building insulation, etc.)?

The new version of the Clean Air 3.0 program introduces the possibility of carrying out thermal modernization of buildings without replacing the heat source. Thermomodernization can be carried out in part, for example, by replacing the windows, or comprehensive. Comprehensive thermo-modernization aims to reduce the consumption of usable energy (EU) for heating the building to no more than 80 kWh/(m2-yr), or at least by a minimum of 40%. Under the program, there is an option to replace PVC windows and aluminum windows, which can help improve the energy efficiency of buildings. It is worth using the services PVC window manufacturers i aluminum, who offer high-quality products that comply with the requirements of the Clean Air Program.

What conditions must be met when applying only for a grant for thermal upgrading work?

In order to be eligible to apply for funding for thermal upgrading work, such as replacing the windows, home insulation or replacement door, it is necessary to meet the following conditions:

- The building permit for the house must be issued before January 1, 2014.

- The building must be equipped with a heat source other than solid fuel or a solid fuel heat source that meets the minimum requirements of Class 5 in accordance with European standard EN 303-5.

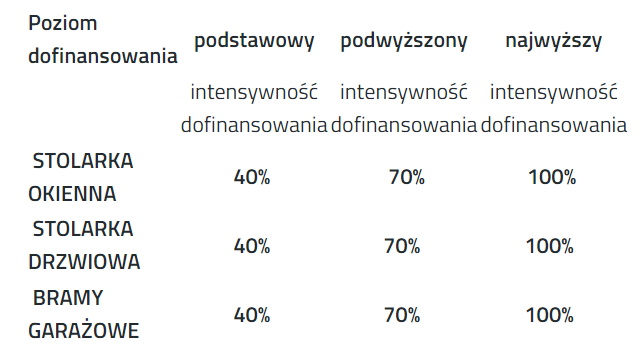

How much funding can be obtained for window replacement as part of thermal upgrading under the Clean Air Program?

There are no set limits on the amount of costs associated with the exchange windows, door or insulation of partitions. On the other hand, the intensity, which is expressed as a percentage of net coverage of the costs incurred, has been established and can be subsidized.

The size of the subsidy depends on income thresholds and applies to replacements windows, door and garage doors.

Which windows meet the requirements of the Clean Air program?

In order to be eligible for a grant to replace woodwork under the Clean Air Program, windows i door must meet the requirements set forth in the Regulation of the Minister of Infrastructure on Technical Conditions effective as of December 31, 2020.

This means that maximum values of the heat transfer coefficient may not exceed on a case-by-case basis:

- Windows / balcony doors - 0.90 [W/(m2K)]

- Skylight windows - 1.10 [W/(m2K)]

- Exterior doors - 1.30 [W/(m2K)]

- Doors/garage doors in heated garages - 1.30 [W/(m2K)].

Is it possible to receive funding for replacement of windows In a multi-family residential building?

For owners of apartments in multi-family buildings, there is an opportunity to apply for funding for replacement PVC windows or aluminum windows As part of the Warm Housing program. Details of the program can be found at https://czystepowietrze.gov.pl/cieple-mieszkanie/. Depending on the amount of income, three levels of subsidies and subsidy intensities have been determined. You can take advantage of both offers from producers PVC windows as well as aluminum windows.

you can receive a grant of 30% of eligible costs, but not exceeding the amount of PLN 15,000 - for the basic level

you can receive a grant of 60% of eligible costs, but not exceeding the amount of PLN 25,000 - for the enhanced level

you can receive a grant of 90% of eligible costs, but not exceeding the amount of PLN 37,500 - for the highest level

In what other programs can you receive additional financial support for replacement windows?

One type of financing for thermal rehabilitation projects is the thermal rehabilitation tax credit. Individuals who own or co-own single-family residential buildings can take advantage of it.

The relief consists of a deduction for expenses incurred for thermal upgrading activities, such as energy efficiency improvements, which leads to a reduction in energy consumption for heating, domestic water heating and residential buildings.

For more information on cost settlement options window replacements under the thermal modernization relief can be found on the program's website. Worth noting are the offers PVC window manufacturers and aluminum windows, which can be covered by this program.

If you do not have sufficient funds, it is possible to take advantage of refinancing investments under the Clean Air+ Program.

Generally, the grants awarded under the Clean Air Program were paid out after the previously reported investment work was completed. However, there is now an option to receive pre-financing, i.e. payment of funds even before the renovation begins. It will be possible to obtain "in advance" up to 50% the maximum amount of the grant, which will be transferred to the contractor's account so that he can begin work.

It is worth noting that this form of financing can apply to various investments, such as aluminum windows, PVC windows, front door and garage doors. For these specific products, you can consult the following manufacturer of PVC windows and aluminum, to learn more about opportunities for pre-financing under the Clean Air Program.

The use of pre-financing under the Clean Air Program is available to beneficiaries who have received funding at the increased or highest level.

It should take a maximum of 14 days to process an application submitted under the Clean Air Program. Once the application is approved, the beneficiary will be able to receive the first tranche of the grant as an advance payment to his contractor account. In the case of investments, such as PVC windows, aluminum windows, front door or garage doors, it is advisable to consult PVC window manufacturers and aluminum, in order to have full knowledge of the possibilities of receiving financing under the Clean Air Program.

Upon completion of the renovation and investment work, the owner of the single-family home will submit a final payment application. The final invoice and confirmation of payment of the beneficiary's own contribution will be submitted with the application. Consideration of the payment application by the territorially competent provincial environmental protection and water management fund and payment of the remaining grant funds should take place within 30 days from the date of submission of documents by the beneficiary.

How can you apply to take advantage of pre-financing?

To apply for funding for the listed products, such as PVC windows, front door or garage doors, you need to send the relevant documents via the NFOŚiGW application generator (GWD). It is possible to electronically sign the application using a trusted profile. If you do not have such a signature, you can also print out the application form, sign it by hand and send it by mail or submit it in person at the information and consultation center in your municipality.

Where and by what date should applications be submitted?

The deadline for submitting applications for funding is from 2018 to the end of 2027. They can be submitted at local branches of the Provincial Environmental Protection and Water Management Funds, as well as online. Detailed information can be found on the official program website.

To obtain an application for participation in the project, go to local branches of the WFOŚiGW or download it from the websites of these funds. To see a complete list of required documentation under the Clean Air Program, please click here: DOCUMENTATION REQUIRED UNDER THE CLEAN AIR PROGRAM.

The subsidies will be paid until September 30, 2029.

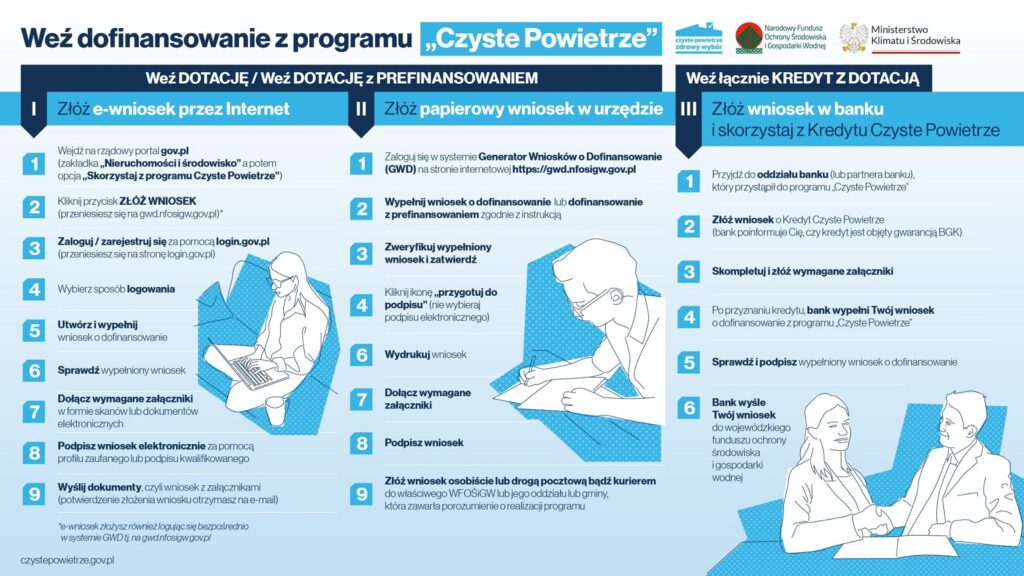

How to apply for funding?

The most convenient way to apply for the Clean Air Program is to submit an application online. If you need to do so, take a peek at the instructions for filling out the application, which can be found here:

INSTRUCTIONS FOR COMPLETING THE APPLICATION TO THE CLEAN AIR PROGRAM:

Useful links:

https://czystepowietrze.gov.pl/czyste-powietrze/

We can deduct as much as PLN 53,000 from our taxes with the thermal rehabilitation tax credit

Another form of financing thermal modernization projects is the thermal modernization tax credit. It may be used by taxpayers who are owners or co-owners of a single-family residential building. The condition is that the thermal modernization project in this building is completed within 3 consecutive years, counting from the end of the tax year in which the first expense was incurred.

How does the thermal modernization relief work?

The relief consists in deducting from the tax base (income - in the case of a flat tax) the expenses incurred for the implementation of a thermal modernization project in a single-family residential building. It is important that the expenses be documented by an invoice issued by a taxpayer of goods and services tax who is not exempt from this tax;

The deduction is made in a return filed for the tax year in which the expenses were incurred. The amount of the deduction not covered by the taxpayer's annual income is deductible in subsequent years, but for no more than 6 years, counting from the end of the tax year in which the first expense was incurred.

Who is eligible for the thermal modernization tax credit?

The right to deduct covers expenses for the implementation of a thermal modernization project only in a single-family residential building, that is, a detached building or a semi-detached, terraced or group building, used to meet residential needs, structurally constituting an independent whole, in which it is allowed to separate no more than two residential units or one residential unit and a commercial unit with a total area not exceeding 30% of the total area of the building.

IMPORTANT: The relief is only available if the property is being renovated. When building a new house, unfortunately, you can't take advantage of the relief. Unfortunately, for the time being, owners of apartments in blocks of apartments will also not benefit from the relief.

How much can be deducted?

The relief limit is not tied to one investment or one thermal modernization project, but rather is specified for a particular taxpayer, regardless of the number of thermomodernization investments. The amount of the deduction may not exceed PLN 53,000 for all thermal modernization projects carried out in individual buildings of which the taxpayer is the owner or co-owner.

Married taxpayers should know that This limit applies to each spouse separately, That is, each of them is entitled to a maximum deduction of PLN 53,000.

The Ministry of Finance has compiled a series of detailed examples and explanations of settlements under the thermal rehabilitation tax credit: Tax clarification thermal modernization relief after consultation.

What can be deducted under the relief? Replacement of windows as part of thermal modernization work.

The relief consists of a deduction of amounts spent on a thermal modernization project, i.e. activities aimed at, among other things, improvements that result in a reduction in the demand for energy supplied for heating and hot water and heating to residential buildings. The measure also includes the purchase of windows and exterior and balcony doors with replacement services.

The Ministry of Investment and Development has compiled a list of construction materials, equipment and services related to the implementation of thermal modernization projects. The list includes, among others:

- Window and door woodwork, including windows, Slope windows with mounting systems, balcony doors, garage doors, non-openable transparent surfaces;

- Replacement of exterior woodwork such as: windows, slope windows, balcony doors, exterior doors, garage doors, non-openable transparent surfaces;

Expenses that have not been financed (subsidized) from the National Environmental Protection and Water Management Fund, provincial environmental protection and water management funds or reimbursed to the taxpayer in any form are deductible.

Subsidies under the Clean Air Program and the thermal upgrading credit

In accordance with Appendix No. 1 to the Clean Air Priority Program, grants under the Clean Air Program can be combined with the thermo-modernization tax credit. In such a case, the benefits obtained by the Beneficiary from both financial mechanisms are complementary.

The subsidy and the rebate are independent instruments to support thermal upgrading projects.

In the case of obtaining benefits jointly from the Clean Air Program subsidy and the thermal rehabilitation tax credit, expenses financed or subsidized by the subsidy or otherwise reimbursed to the taxpayer from public funds are not deductible under the credit, but only that part of them that was not subsidized.

| CLEAN AIR PROGRAM | THERMAL MODERNIZATION RELIEF |

|

|

|

|

|

|

|

|

|

Important information in one place

- Taxpayers who account for their income according to the tax scale (rates of 17% and 32%) or according to the uniform 19% tax rate, as well as those who pay a lump sum on registered income (so-called lump sum taxpayers), have the opportunity to deduct the allowance.

- The deduction of the allowance is made in the tax return filed for the tax year in which the renovation expenses for thermal rehabilitation were incurred, or "the amount of the deduction not covered by the taxpayer's annual income is deductible in subsequent years, but for no more than six years, counting from the end of the tax year in which the first expense was incurred."

- The amount of the relief may not exceed PLN 53,000 for a taxpayer who owns or co-owns a residential house, regardless of the number of thermal modernization projects he carries out.

Useful links:

https://www.podatki.gov.pl/pit/ulgi-odliczenia-i-zwolnienia/ulga-termomodernizacyjna/